Weeks after floating its currency, Ethiopia is set to run an auction to help stabilize the plummeting currency.

The National Bank of Ethiopia (NBE) has announced a Special Foreign Exchange Auction scheduled for August 7 2024. This auction allows interested banks to bid for U.S. dollars, an essential step in managing foreign exchange reserves and ensuring currency stability within the country.

Special Foreign Exchange Sale Auction Announcement pic.twitter.com/roeGadSpwU

— National Bank of Ethiopia (@NBEthiopia) August 6, 2024

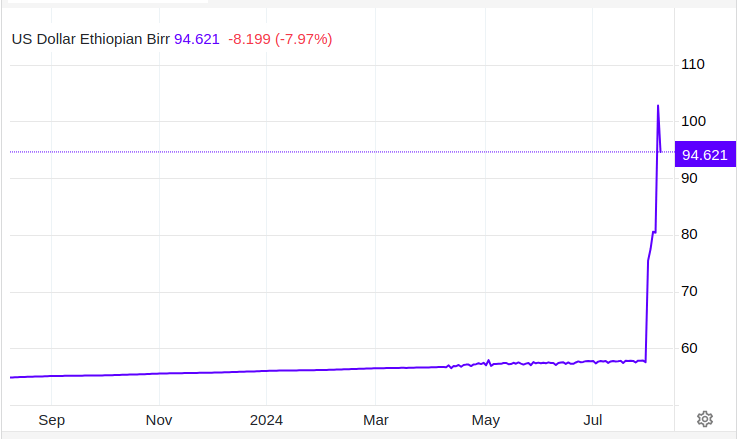

Since the removal of foreign currency restrictions, the Birr has since then lost approximately 47% against the dollar, to trade at 94.62 per greenback, according to data collected by Trading Economics. Economic analysts and commentators have voiced concern that inflation could surge.

However, Prime Minister Abiy has defended the recent measures which also included the removal of restrictions on foreign exchange trade.

“Saying Ethiopia has devalued its currency is wrong,” Abiy said last Thursday in a televised briefing to explain the new policy.

“There were two markets. One is 100 and the other is 50. So when the gap between the two became wide, it brought many dangers. So what we said (the two) should be unified,” he said.

[TECH] REGULATION | Ethiopia Floats Exchange Rate in a Significant Policy Shift as it Intensifies Reforms Towards a Free Market Economy: The Ethiopian government has announced the implementation of a market-.. https://t.co/g6DSjR3Awj via @BitcoinKE

— Top Kenyan Blogs (@Blogs_Kenya) July 29, 2024

In the planned auction, successful banks will be allocated U.S. dollars based on the bid price they have offered. The NBE has specified that no single bank will receive more than 20 percent of the total funds available at the auction. This measure ensures a more equitable distribution of foreign exchange resources among the participating banks.

Additionally, banks are required to settle their purchases on the same day as the auction. The prompt settlement requirement is crucial for maintaining the integrity and efficiency of the auction process.

The NBE has indicated that, depending on market conditions, additional foreign exchange auctions may be conducted over the coming weeks. This flexibility allows the NBE to respond dynamically to changing economic and financial conditions, ensuring a stable and orderly foreign exchange market.

Follow us on X for the latest posts and updates

Join and interact with our Telegram community

__________________________________________

__________________________________________