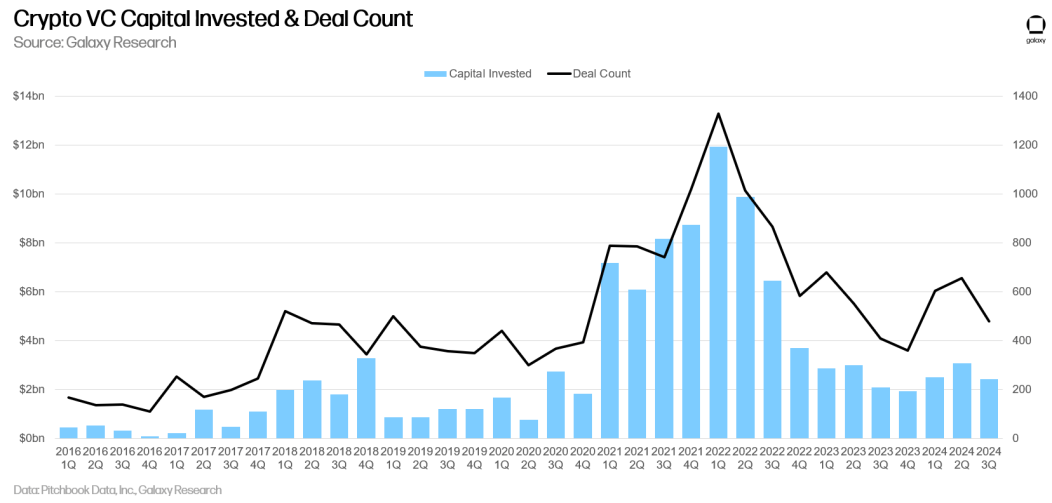

According to a new report by Galaxy Digital, venture capital investment in crypto startups declined to $2.4 billion in Q3 2024, a 20% decline from the previous quarter, with the number of deals dropping by 17% to 478.

After three quarters, venture capitalists have invested $8 billion in crypto startups, putting 2024 on track to meet or slightly exceed 2023, said the report.

Early-stage deals captured the most capital investment (85%), while later-stage deals accounted for only 15% of capital, the lowest since Q1 2020.

Median valuations in venture capital increased in both Q2 and Q3 2024, with crypto-specific deal valuations growing at a faster pace than the broader VC industry.

In Q3 2024, the median deal valuation was $23.8 million, slightly lower than the $25 million recorded in Q2 2024.

The report notes that the multi-year correlation between Bitcoin price and capital invested into crypto startups has broken down, with Bitcoin rising significantly since January 2023 while venture capital activity has struggled to keep pace.

When the quarter’s performance is broken down into categories, companies and projects in the “Trading/Exchange/Investing/Lending” category secured the largest share of crypto VC capital, accounting for 18.43% and raising a total of $462.3 million.

The two biggest deals in this category were:

Cryptospherex, which raised $200 million, and

Figure Markets, securing $73.3 million

In particular, crypto startups focused on building AI services saw a 5-fold increase in crypto VC funding quarter-over-quarter. Notable contributors to this surge were:

Sentient – raised $85 million

CeTi – raised $60 million

Sahara AI – raised $43 million

significantly boosting VC investment in AI-driven crypto projects.

Trading/Exchange/Investing/Lending and Layer 1 crypto projects saw a significant 50% quarter-over-quarter increase in crypto VC funding.

In contrast, Web3/NFT/DAO/Metaverse/Gaming projects experienced the largest decline, with a 39% reduction in VC investment compared to the previous quarter.

When it comes to deals per location:

43.5% of all crypto deals raised during the quarter were with companies headquartered in the United States.

Singapore ranked second with 8.7%, followed by

The United Kingdom at 6.8%,

The UAE at 3.8%, and

Switzerland at 3%

In terms of total VC funding:

Companies based in the United States attracted 56% of all venture capital invested, marking a slight 5% increase quarter-over-quarter.

The United Kingdom secured 11% of the total, followed by

Singapore with 7%, and

Hong Kong with 4%.

Companies and projects founded in 2021 took in the largest share of capital, while those founded in 2022 accounted for the most number of deals.

Click here for the full analysis by Galaxy Digital.

________________________________________