The International Monetary Fund (IMF) has released an October 2024 paper examining the possible options between:

Central bank digital currencies (CBDCs)

Faster payment systems (FPS), and

e-Money

With a particular emphasis on emerging markets, the paper underscores the risks that dollar stablecoins and foreign CBDCs pose to monetary sovereignty.

“The IMF is often approached with the question of how a retail central bank digital currency (CBDC) compares to fast payment systems (FPSs) and even e-money, and which to prioritize in the context of constrained resources.

There is no ‘one answer’ to this question; working through this analysis requires authorities to carefully consider their jurisdictions’ payments landscape, their objectives and core needs, and the practical constraints which they face.

– International Monetary Fund (IMF)

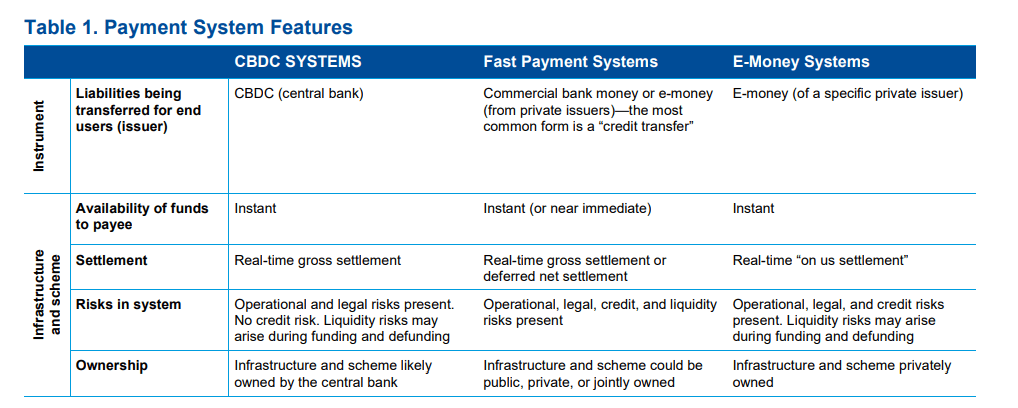

According to the global institution, the fundamental difference between CBDC, FPS, and e-money is that CBDCs are first and foremost a form of central bank money that could sustain the presence and choice to use a publicly issued money, as well as a public payment solution, in a retail payments landscape which may otherwise be moving toward 100 percent private money.

In contrast, FPSs are payment arrangements to smooth and accelerate the transfer of private liabilities, and e-money are private liabilities which act as an alternative to bank deposits with a lower access threshold in many markets.

Brazil’s Pix and India’s UPI represent two prominent FPS success stories of recent years, according to IMF.

Meanwhile, the success of AliPay and WeChat Pay in China and M-Pesa in Kenya, categorized as E-money, showcases how primarily closed-loop systems can establish a substantial market share through network effects.

According to the IMF, CBDC has two distinct benefits. The most significant benefit is maintaining retail access to central bank money as cash usage declines, noting a troubling trend whereby as cash becomes less utilized, fewer merchants are inclined to accept it.

By providing access to a CBDC, central banks can effectively tackle the two primary threats to monetary sovereignty posed by stablecoins and foreign CBDCs.

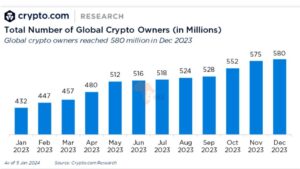

“Although stablecoins have not gained much use outside of crypto-asset ecosystems in advanced economies, preliminary data suggest that in emerging and developing market economies, they are being used in a limited capacity for cross-border transactions and remittances (FSB 2024).”

The same analysis also suggested that there was a perceived preference for U.S. dollar-denominated stablecoins as a store of value in countries with high inflation, currency devaluation, or the presence of capital flow measures, the authors wrote.

They warn that if there’s significant adoption, a stablecoin could start being used as an alternative unit of account.

The IMF also sees competition as another area where a CBDC can offer advantages. Private faster payment systems (FPS) may limit competition, while many e-money systems operate as closed loops, potentially leading to monopolistic behavior.

In contrast, the IMF believes that a CBDC could reduce barriers for non-bank payment service providers fostering greater competition in the financial ecosystem.

________________________________________